Bloomberg New Energy Finance Forecasts Rocky Shift toward Solar

The Bloomberg New Energy Finance (BNEF) Future of Energy Summit took place in New York City on April 4 and 5. In his international forecast keynote, Michael Liebreich, chairman of the BNEF advisory board, said 2015 was a landmark year for renewable energy but a dismal one for coal and oil. Demand for natural gas – especially exports of liquefied natural gas – is “alive and well and gathering speed,” he said.

Liebreich said that despite the lowest crude oil prices seen since 2009, the $329 billion invested in clean energy in 2015 set a new record. “We now know we are in a ‘low cost of oil’ environment for the foreseeable future. But did that stop investment in renewables? Absolutely not.”

Capital expenditure investment in oil and gas dropped 36 percent in 2015 and, for the first time, fell below total investment in clean energy. The trend is likely to continue, since fossil fuel companies have canceled trillions of dollars’ worth of future projects, Liebreich said.

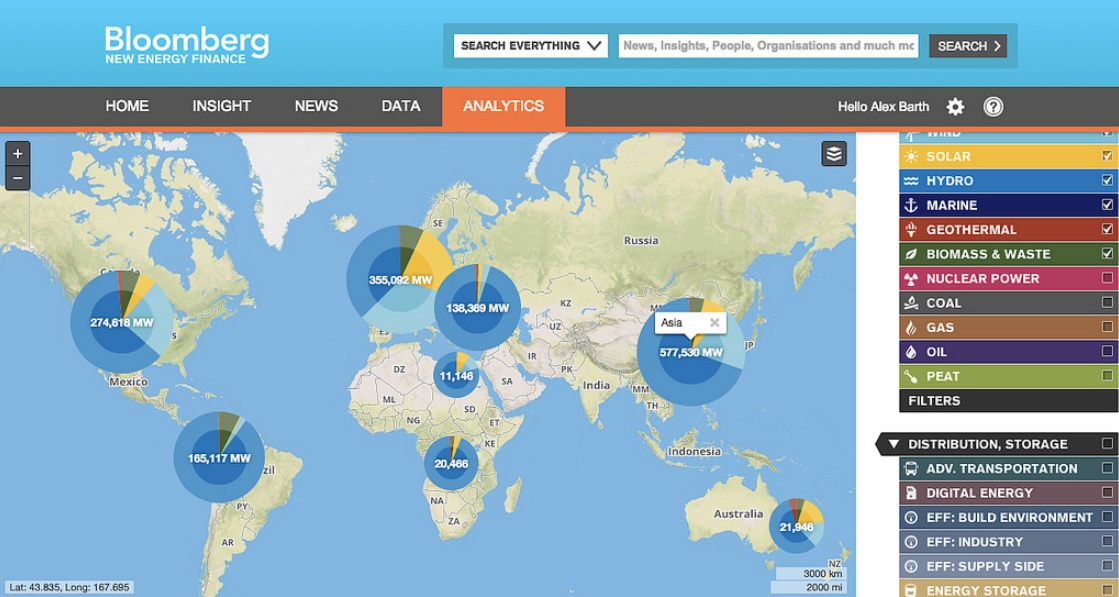

Liebreich said new power generation also reflected this trend. Investment in renewable generating capacity in 2015 outpaced investment in fossil fuel-based generation by a factor of around two. In January 2016, a wind power project in Morocco set the record for the cheapest new source of generation, with an unsubsidized rate of 3¢ per kWh. Still, the global shares of wind and solar generating capacity are currently about one and three percent, respectively.

Liebreich said the last 12 years have seen a pattern of policies that incentivized adding clean generation capacity. In the United States alone, the recent renewable energy tax credit extensions will add almost 40 GW of new wind and solar projects between 2017 and 2021. Due in large part to the extension, Liebreich said BNEF predicted that the stay of the Clean Power Plan will not change the trajectory of the United States power system over the medium to long term.

Despite the favorable trends in the industry, Liebreich cautioned against the market imbalances that have resulted in negative electricity prices in countries like Germany. He said, “The focus now needs to be on removing over-capacity. Otherwise, the collapses that we’ve seen in wholesale prices around the world are not going to reverse – which makes it very difficult to keep the lights on when it isn’t sunny and isn’t windy.”

Electric vehicles, batteries, and energy “miracles”

Liebreich said he calls the 276,000 orders received by Tesla in the first three days of the Model 3’s launch the “miracle of Musk.” He said the orders represent $11.6 billion in revenue for Tesla and dwarf other recent product launches, such as Apple’s iPhone 6, which returned $3.5 billion.

By the time the Tesla Gigafactory 1 and other large-scale battery manufacturers scale up in 2018, the price of electric vehicle lithium-ion battery packs will have fallen by 77 percent since 2010. “Cost parity with internal-combustion cars will [arrive] between 2022 and 2026, depending on the price of oil,” he said.

Liebreich forecasted the state of the electric vehicle industry in 2040. He said he expects 35 percent of all new cars will be electric by then, but the total could be as high as 50 percent, depending on oil prices and the evolution of the ride-sharing economy. He also said China will emerge as the leading manufacturer. The new electric vehicles will add 10 percent to global electricity demand, displacing $13 million barrels a day in oil use.

Other clean-energy technologies to watch include small modular nuclear reactors and potentially fusion power, though the latter is still far from becoming a reality, Liebreich said.

According to Liebreich, Bill Gates has said that “we need an energy miracle” to keep average global temperatures from rising by more than 2°C.

However, the real miracle may be found closer to home, he said: solar and wind. Liebreich said that solar’s share of generation doubled seven times in the last 15 years while wind has doubled four times. “To be a miracle, you need scale – and there you see the rate at which these technologies are growing.”

A dangerous economic slowdown in China

Liebreich said that while China has powered through the recent financial crises, its economy is restructuring dramatically. It emerged as the first country to invest more than $100 billion in one year in clean energy. It accounted for 1/3 of the total global investment in the sector in 2015.

“[China’s] GDP is on a glide path and has now come down to around seven percent per year,” Liebreich said. National growth in electricity demand has dropped to almost zero, demand for coal is flat, and growth in emissions has stopped.

“I’ve tried to work out how you can have an economy growing at seven percent, electricity [demand] growing at zero percent or 0.5 percent, and whether you can explain that just with a shift from heavy industry to services and other parts of the economy… and I could not make the arithmetic add up,” Liebreich said. “My sense is that the GDP figure is the one I would question.”

Liebreich said that in the environment of flat energy demand, China’s enormous and even growing investment in new generation has led capacity factors to drop through the floor.

“Between 2011 and 2016, the average capacity factor of Chinese thermal power plants dropped from 61 percent to 49 percent. This is not sustainable,” Liebreich said. “This is a microcosm of what is happening in the Chinese economy across other sectors as well [such as] glass, steel… overinvestment, overcapacity… We need to watch this very carefully.”

In contrast to China, Liebreich said European investment in clean energy peaked in 2011, falling from $119.5 billion in that year to $46.3 billion in 2015. He said growth was slowed by the European financial crises and was now being dampened by interconnection challenges and the need to restructure national power markets in response to the high penetration of renewables.

Join our LinkedIn group to discuss this article. You may also email the author directly using our contact form.